Hướng Dẫn A debt service fund is a ?

Kinh Nghiệm Hướng dẫn A debt service fund is a 2022

Bùi Xuân Trường đang tìm kiếm từ khóa A debt service fund is a được Cập Nhật vào lúc : 2022-12-27 11:40:14 . Với phương châm chia sẻ Mẹo Hướng dẫn trong nội dung bài viết một cách Chi Tiết Mới Nhất. Nếu sau khi tham khảo nội dung bài viết vẫn ko hiểu thì hoàn toàn có thể lại Comment ở cuối bài để Tác giả lý giải và hướng dẫn lại nha.Coppell's Debt Service Fund is used to account for the accumulation of financial resources for the payment of principal, interest and related costs for general long-term debt paid primarily from taxes levied by the City. Debt – typically in the form of Certificates of Obligation – is issued as needed to provide for infrastructure improvements and public safety projects.

Nội dung chính Show- Debt Refinancing and RepaymentAAA Bond RatingDefinition[edit]External debt sustainability[edit]Is a debt service fund a governmental fund?What is debt servicing example?How is the debt service fund funded?

Debt Usage

Per the City's Charter and State and Federal law and with City Council approval, the City uses debt to finance the construction, acquisition or renovation of infrastructure. The City may also issue bonds to refinance existing debt when there is an opportunity to obtain a better interest rate and decrease interest expense. The City does not issue debt – or use any proceeds from issuing debt – to finance operations or for normal maintenance.

Debt Refinancing and Repayment

Each year, City staff reviews any outstanding debt to determine whether or not there is an opportunity to refinance the debt a better rate. By refinancing, the City is able to reduce the amount of its payment on the debt, and this in turn allows the City to use taxpayer funds for other projects.

AAA Bond Rating

Because the City of Coppell has retained its AAA bond rating, the City is afforded a low interest rate on any debt issued.

The City's AAA bond rating is significant because it lowers the cost of borrowing for Coppell taxpayers. The City will realize significant savings over the life of any Certificates of Obligations issued for projects. It's also possible that bonds issued by the City will sell a premium. In this case, the City will be able to reduce the amount of debt issued.

Debt service refers to the money that a person, business, or government needs in order to cover the payments on a loan or other debt for a particular time period. A company's debt-service coverage ratio measures its ability to handle additional debt by comparing its available income to the amount it is currently paying to service its debts.

Debt service funds are not used to account for loans outstanding. Loans outstanding are only reported in a general, special revenue or proprietary fund type.

If bonds were issued for the loan program, debt service funds are not necessarily required. For proprietary fund reporting, both the bond liability on the balance sheet and the debt service payments on the operating statement are presented within the proprietary fund. Debt service payments may be reported in a general or special revenue fund with the bond liability presented in the long-term liabilities adjustment column for governmental activities.

A debt service fund may be used to report resources used and payment of debt service for bonds associated with the loan program for governmental activities. Debt service funds are required only if legally mandated or resources are being accumulated for future debt service payments. If used, the debt service funds do not present the loans outstanding. Resources obtained from the loan repayments for debt service payments are presented as transfers from the general or special revenue fund to the debt service fund.

The purpose of the Debt Service Fund is to account for the payment of principal and interest due on the City’s debt, both bonded and unbonded. All enterprise debt is budgeted within the corresponding fund.

Property Tax. Revenues in this fund are voter approved taxes collected to pay the 2005 General Obligation (GO) Bonds for Fire Station #1, and 2012 GO Bonds for Fire Station #2.

Charges for Services. Revenues primarily include payments from system users in other funds to meet technology debt service requirements.

Assessment Payments. These payments are from individual benefited property owners who pay for principal and interest for property or service improvements over a period of time a rate established when the assessment is financed.

Operating Transfers In. These transfers are from the Capital Improvements Fund to support “Open Space” debt for land purchases.

A debt service fund is a cash reserve that is used to pay for the interest and principal payments on certain types of debt. The existence of a debt service fund is intended to reduce the risk of a debt security for investors, which makes it more attractive to them and also reduces the effective interest rate needed to sell the offering. However, it ties up a portion of the cash that the debt issuer receives from the debt offering, so that it cannot be applied to more useful investments.

A country's gross external debt (or foreign debt) is the liabilities that are owed to nonresidents by residents.: 5 The debtors can be governments, corporations or citizens.: 41–43 External debt may be denominated in domestic or foreign currency.: 71–72 It includes amounts owed to private commercial banks, foreign governments, or international financial institutions such as the International Monetary Fund (IMF) and the World Bank.

External debt measures an economy's obligations to make future payments and, therefore, is an indicator of a country's vulnerability to solvency and liquidity problems.: xi–xii Another useful indicator is the net external debt position, which equals gross external debt less external assets in the form of debt instruments.: 1–2 A related concept is the net international investment position (net IIP). Provided that debt securities are measured market value, the net external debt position equals the net IIP excluding equity and investment fund shares, financial derivatives, and employee stock options.: 44, 82

Definition[edit]

According to the International Monetary Fund's External Debt Statistics: Guide for Compilers and Users, "Gross external debt, any given time, is the outstanding amount of those actual current, and not contingent, liabilities that require payment(s) of principal and/or interest by the debtor some point(s) in the future and that are owed to nonresidents by residents of an economy.": 5

In this definition, the IMF defines the key elements as follows:

Outstanding and actual current liabilitiesDebt liabilities include arrears of both and interest.Principal and interestWhen the cost of borrowing is paid periodically, as commonly occurs, it is known as an interest payment. All other payments of economic value by the debtor to the creditor that reduce the principal amount outstanding are known as principal payments. However, the definition of external debt does not distinguish between principal payments or interest payments, or payments for both. Also, the definition does not specify that the timing of the future payments of principal and/or interest need be known for a liability to be classified as debt.ResidenceTo qualify as external debt, the debt liabilities must be owed by a resident to a nonresident. Residence is determined by where the debtor and creditor have their centers of economic interest—typically, where they are ordinarily located—and not by their nationality.Current and not contingentContingent liabilities are not included in the definition of external debt. These are defined as arrangements under which one or more conditions must be fulfilled before a financial transaction takes place. However, from the viewpoint of understanding vulnerability, there is analytical interest in the potential impact of contingent liabilities on an economy and on particular institutional sectors, such as the government.Generally, external debt is classified into four heads:

(1) public and publicly guaranteed debt;(2) private non-guaranteed credits;(3) central bank deposits; and(4) loans due to the IMF.However, the exact treatment varies from country to country. For example, while Egypt maintains this four-head classification, in India it is classified in seven heads:

(a) Multilateral,(b) Bilateral,(c) IMF loans,(d) Trade credit,(e) Commercial borrowings,(f) Non-resident Indian and person of Indian origin deposits,(g) Rupee debt, and(h) NPR debt.External debt sustainability[edit]

Map of countries by external debt as a percentage of GDP

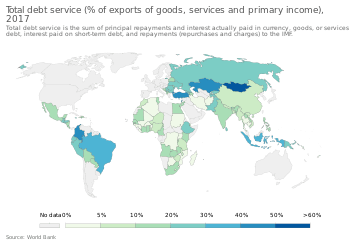

Total debt service as % of exports of goods, services and primary income in 2022.

Share of U.S. gross external debt by debtors.

Sustainable debt is the level of debt which allows a debtor country to meet its current and future debt service obligations in full, without recourse to further debt relief or rescheduling, avoiding accumulation of arrears, while allowing an acceptable level of economic growth.

External-debt-sustainability analysis is generally conducted in the context of medium-term scenarios. These scenarios are numerical evaluations that take account of expectations of the behavior of economic variables and other factors to determine the conditions under which debt and other indicators would stabilize reasonable levels, the major risks to the economy, and the need and scope for policy adjustment. In these analyses, macroeconomic uncertainties, such as the outlook for the current account, and policy uncertainties, such as for fiscal policy, tend to dominate the medium-term outlook.

The World Bank and IMF hold that "a country can be said to achieve external debt sustainability if it can meet its current and future external debt service obligations in full, without recourse to debt rescheduling or the accumulation of arrears and without compromising growth". According to these two institutions, "bringing the net present value (NPV) of external public debt down to about 150 percent of a country's exports or 250 percent of a country's revenues" would help eliminating this "critical barrier to longer-term debt sustainability". High external debt is believed to be harmful for the economy.

There are various indicators for determining a sustainable level of external debt. While each has its own advantage and peculiarity to giảm giá with particular situations, there is no unanimous opinion amongst economists as to a sole indicator. These indicators are primarily in the nature of ratios—i.e., comparison between two heads and the relation thereon and thus facilitate the policy makers in their external debt management exercise. These indicators can be thought of as measures of the country's "solvency" in that they consider the stock of debt certain time in relation to the country's ability to generate resources to repay the outstanding balance.

Examples of debt burden indicators include the

(a) Debt-to-GDP ratio,(b) foreign debt to exports ratio,(c) government debt to current fiscal revenue ratio etc.This set of indicators also covers the structure of the outstanding debt, including:

(d) Share of foreign debt,(e) Short-term debt, and(f) Concessional debt ("loans with an original grant element of 25 percent or more") in the total debt stock.A second set of indicators focuses on the short-term liquidity requirements of the country with respect to its debt service obligations. These indicators are not only useful early-warning signs of debt service problems, but also highlight the impact of the inter-temporal trade-offs arising from past borrowing decisions. Examples of liquidity monitoring indicators include the

(a) Debt service to GDP ratio,(b) Foreign debt service to exports ratio,(c) Government debt service to current fiscal revenue ratioThe final indicators are more forward-looking, as they point out how the debt burden will evolve over time, given the current stock of data and average interest rate. The dynamic ratios show how the debt-burden ratios would change in the absence of repayments or new disbursements, indicating the stability of the debt burden. An example of a dynamic ratio is the ratio of the average interest rate on outstanding debt to the growth rate of nominal GDP.

Is a debt service fund a governmental fund?

There are five main types of government funds, which includes the general fund, the capital projects fund, the permanent fund, the special revenue fund, and the debt service fund.What is debt servicing example?

A common timeframe for debt service is a year. For example, if you have a $100,000 loan 6% interest for 10 years, debt service might be measured by 12 monthly payments of $1,110.21. In other words, your annual debt service for this loan is $13,322.52.How is the debt service fund funded?

Property taxes are the primary funding source for repayment of annual debt service, with about 15% of the tax rate allocated directly to the Debt Service Fund. The allocation for debt service has been reduced over the past decade through controlled limitation of new debt issuance. Tải thêm tài liệu liên quan đến nội dung bài viết A debt service fund is a Internal service fund